KMC University Library Tour

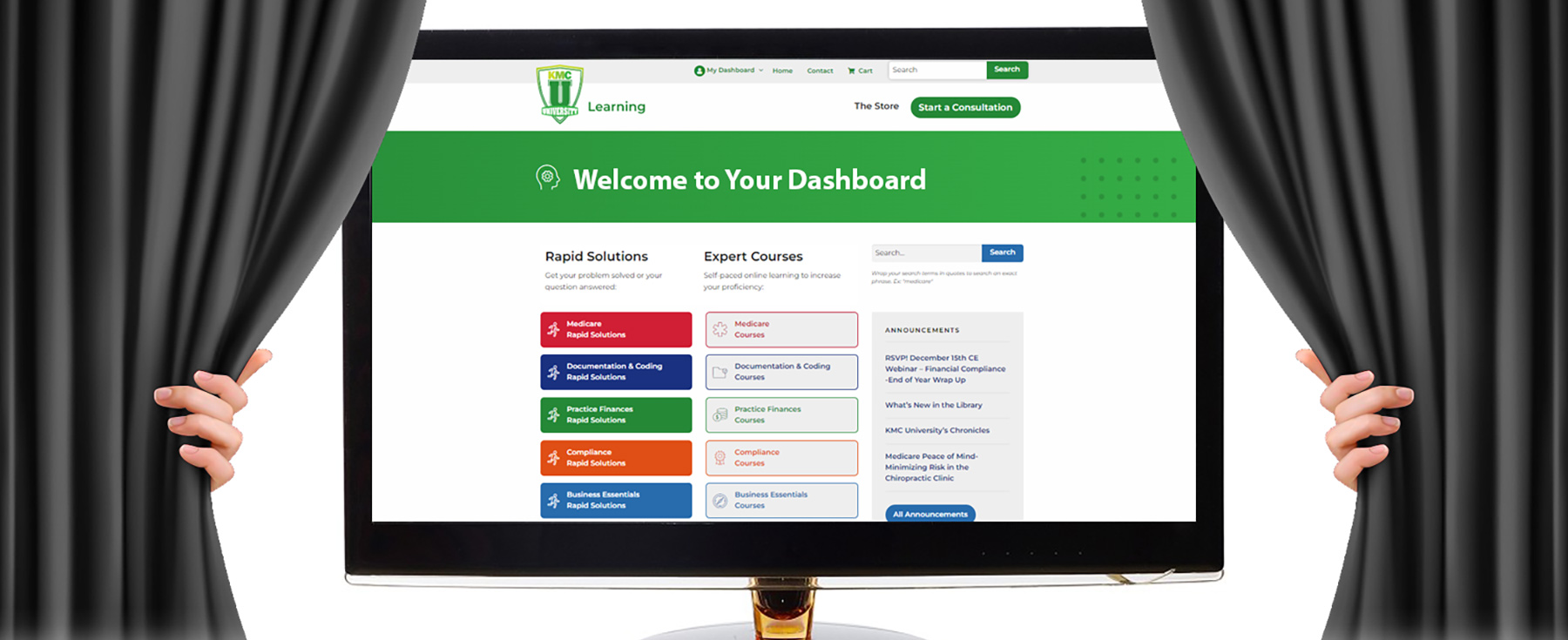

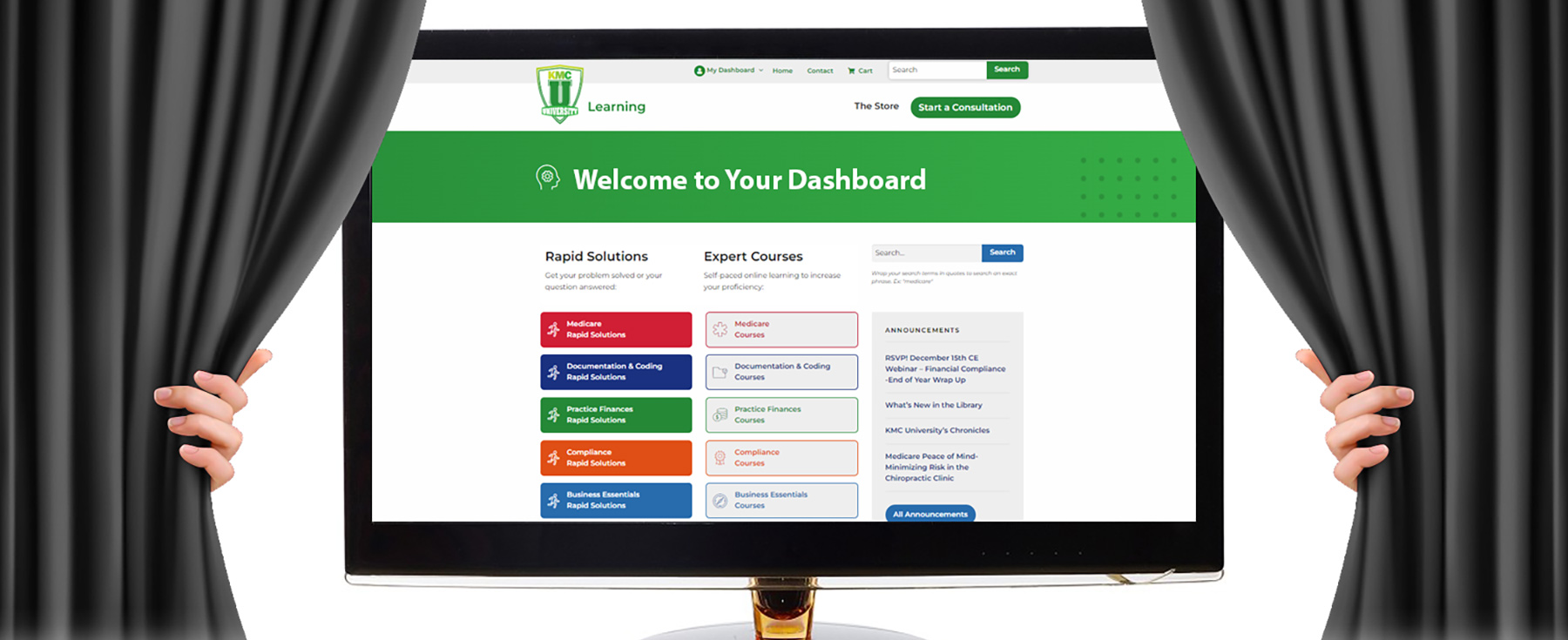

Check out this behind the scenes peek into the wealth of information in the KMC University Library with Marty!

This Documentation Gap Analysis allows us to evaluate the significant components of your current Documentation program. It should take less than 5 minutes to complete.

Sometimes you need more than a self-service, on-demand program and need an expert to analyze your issues, train the corrections, and help you implement the changes, so they stick

This course explains the significant role chiropractic care can play in the sports industry and how a DC can succeed as a Sports Chiropractor. Start your steps to success here!

The most effective chiropractic OIG compliance programs are scaled according to the size of the practice!

Check out this behind the scenes peek into the wealth of information in the KMC University Library with Marty!

Remember, just because you receive reimbursement does not mean all is well. If suddenly targeted for an audit, you will likely have to reimburse the insurance carrier for monies paid unless all required documentation has been provided.

It sounds simple, but if it were, a large percent of chiropractic practices wouldn’t be getting it wrong!

Has Yours Arrived Yet? The Center for Medicare and Medicaid Services (CMS) contracts with Reli, an external contractor, to provide these CBRs for providers of all kinds. They are landing in providers’ offices in February and March this year. So now what?

There are several steps that can be taken to improve your documentation, coding, and compliance and not let your resolution remain unfulfilled.

Leave a comment below to celebrate with KMC!…

Starting February 1st all appeals must be submitted electronically for United Healthcare UHC claims. From reconsiderations to appeals, the electronic only submission requirement will impact providers nationwide.

KMC University’s Chronicles, now available to download! Your summary of the latest reimbursement and compliance news.

According to the Centers of Medicare and Medicaid Services (CMS), there are ten principles to adhere to in the documentation of a medical record. Let’s take a look:

As the provider is not tasked with both treating the patient and documenting the encounter at the same time, services performed are often more accurately documented, which contributes to more proficient coding as well, minimizing risk.