Medicare Billing Rules

Once you have an understanding of the different types of Medicare plans, and are ready to submit claims to the appropriate plan, it is important that your billing be accurate. Most Medicare denials are preventable if you follow the billing rules. Unfortunately, many providers are completely unaware of the rules and therefore make costly mistakes. Invest in your practice by getting to know the basic rules of Medicare billing.

Paper or Electronic- Do You Have A Choice?

The Administrative Simplification Compliance Act (ASCA) prohibits payment of initial health care claims not sent electronically, except in limited situations. The exclusion that applies to most Doctor of Chiropractic is the ‘small provider claims.’ CMS states:

Physicians and suppliers with fewer than 10 FTEs and that are required to bill a Medicare Administrative Contractor (MAC) or Durable Medical Equipment (DME) are classified as small. See section 90.1 of Chapter 24 of the Medicare Claims Processing Manual (Pub. 100-04) for more detailed information on calculation of FTE employees and this ASCA requirement in general, and/or claims from providers that submit fewer than 10 claims per month on average during a calendar year.

Self-Assessment

Don’t assume you qualify for paper submission. Be sure to consult the details in the Medicare Claims Processing Manual. For example, did you know, workforce members who perform services for a provider under contract, such as individuals employed by a billing agency or medical placement service, for whom a provider does not withhold taxes, are not considered members of a provider’s staff for FTE calculation purposes? Don’t count these individuals!

How about part-time workers – did you know, part time employee hours must also be counted when determining the number of FTEs employed by a provider. For example, if a provider has a policy that anyone who works at least 35 hours per week on average qualifies for fulltime benefits, and has 5 full-time employees and 7 part-time employees, each of whom works 25 hours a week, that provider would have 10 FTEs (5+[7 x 25= 175 divided by 35= 5])

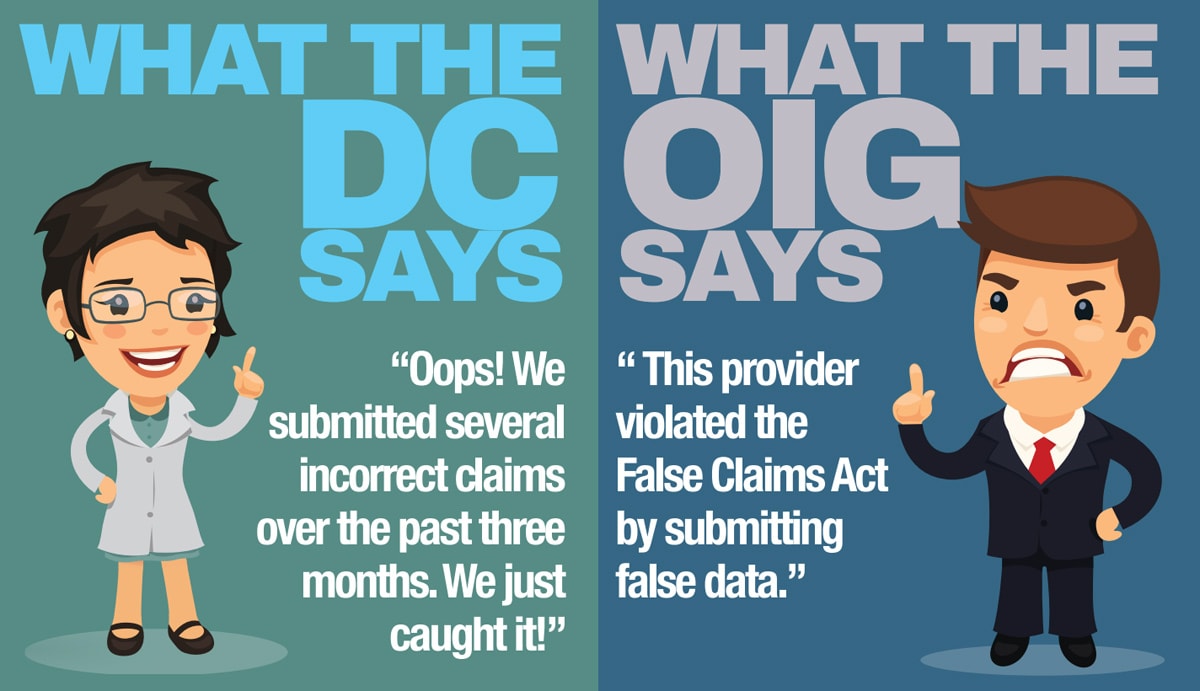

OOPS! A Post-Payment Enforcement-What Should You Do?

According to CMS the process is as follows: “Your Medicare contractor will analyze reports displaying the number of paper claims that all providers submitted each quarter. By the end of the month following the quarter, selected providers who have submitted the highest numbers of paper claims will be reviewed. Medicare contractors will ask these providers to provide information that establishes the exception criteria listed above. If you, as one such provider, do not respond to this initial “Request for Documentation” letter within 45 days of receipt, your contractor will notify you by mail that Medicare will deny and not pay any paper claims that you submit beginning ninety days after the date of the initial request letter. If you do respond to this initial letter, and your response does not establish eligibility to submit paper claims, the contractor will notify you by mail of your ineligibility to submit paper claims. This Medicare decision is not subject to appeal.” https://www.cms.gov/Outreach-and-Education/Medicare-Learning-Network-MLN/MLNMattersArticles/downloads/MM3440.pdf

When in doubt reach out to your local Medicare Administrative Contractor (MAC), they often have helpful tools online to assist with determining eligibility for paper claim submission. Do not ignore post-payment request. Train your staff to keep an eye out for them.

So, what about those modifiers? Check out Know Before You Bill-Medicare Modifiers

KMC University provides a valuable service for chiropractic providers. I purchased a library membership and a coach to guide me as I audited and made changes to clinic SOPs. This program is useful in ensuring compliance, training staff, and confirming the decisions I make for the practice. Even though the practice is operating smoothly, I rely on KMC University to keep me informed of updates and changes in the industry. I continue to be a KMC member and utilize an individual coaching session as the need arises. You will not go wrong with KMC University. From the help desk to Kathy Weidner herself, every individual I have encountered has been friendly, helpful, and provided value.