What is a Third-Party Payer in Healthcare?

If you are entering the world of billing insurance, a common term you will hear is third-party payer. The term is defined as ‘an entity (other than the patient or health care provider) that reimburses and manages health care expenses.” Third-party payers include insurance companies, governmental payers, like Medicare, and even employers (self-insured plans). The patient has an agreement with the payer to reimburse the provider. A provider dealing with third party payers usually has a contract with them in order to receive payment.

Get to Know Your Payer Types |

|

| Type of Insurance | Description |

| Indemnity Policies (Traditional Fee-for-Service Insurance) | Most indemnity policies allow the patient to choose any doctor and hospital they wish when seeking health care services. The biggest benefit of traditional fee-for-service insurance is choice. The patient decides which provider to see with few geographic limitations… |

| Preferred Provider Organizations (PPOs) | A Preferred Provider Organization (PPO) provides a list of contracted “preferred” providers from which a patient can choose. The patient receives the highest monetary benefit when s/he limits health care services to the providers on the list… |

| Health Maintenance Organizations (HMOs or Managed Care) | Membership in a Health Maintenance Organization (HMO) requires members to obtain health care services from doctors and hospitals affiliated with the HMO. It is common practice in HMOs for the plan member to choose a primary care physician who treats and directs health care decisions and coordinates referrals to specialists within the HMO network… |

| Self-Insured Health Plans (Single Employer Self-Insured Plans) | Self-Insured Health Plans have gained in popularity with large employers, labor unions, school districts, and other municipalities. These groups establish a pool of money and then pay for their members’ (employees’) health care services from this pool… |

| Exclusive Provider Organizations (EPOs) | Exclusive Provider Organizations (EPOs) provide lists of local contracted, preferred providers (doctors and hospitals) from which a patient can choose. The patient is only covered by his/her plan if s/he seeks treatment with a provider who participates in their network… |

| High Deductible Health Plans (HDHPs) | A high-deductible health plan is a health insurance plan with a higher deductible than a traditional health plan. High deductible health plans have lower premiums making them attractive to employer groups and those purchasing their insurance through the ACA exchanges… |

| COBRA | The Consolidated Omnibus Budget Reconciliation Act (COBRA) is a federal law that extends a patient’s current group health insurance when s/he experiences a qualifying event such as termination of employment or reduction of hours. The extension period is 18 months; some people with special qualifying events may be eligible for a longer extension… |

Click here to review the full Fact Sheet on Payer Types

Dealing with insurance on behalf of patients is one of the most core and basic tenets of the business of healthcare. Invest appropriate time and energy into learning how it works; understanding the expectations of providers; and assuring adequate training for your office team.

KMC University is the profession’s expert in third-party payer mechanics. Questions? Contact us today.

Call (855) 832-6562 now or click to schedule a 15-minute Solution Consultation at your convenience.

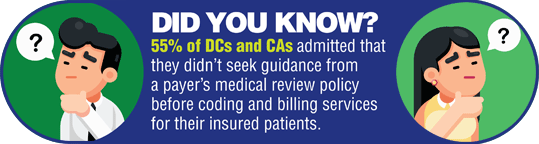

Do you know how to find your carrier’s Medical Review Policy?

Click below to learn how you can gather and store these documents.

|

|

Provides my office with much needed assistance and guidelines for managing in the insurance and Medicare world.