Understanding Medicare for Chiropractic Care:

What You Need to Know

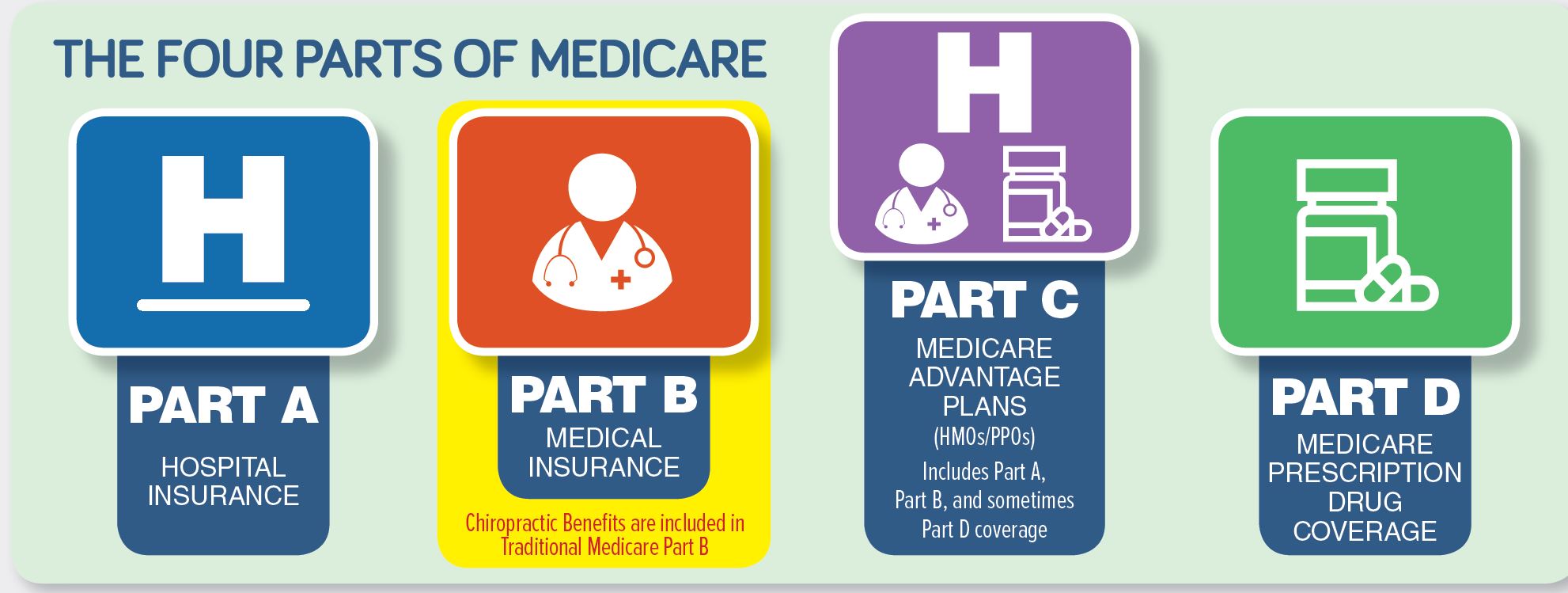

Medicare Basics

Medicare is a government health insurance program primarily for people 65 and older or on disability. However, not all Medicare plans work the same way. Some plans let you visit any doctor that accepts Medicare, while others have networks and rules you must follow. Medicare beneficiaries choose either Part B or Part C Medicare when enrolling, and can change these options annually, during an open enrollment period.

What does this mean for you?

What does this mean for you?

If you’re a Medicare beneficiary seeking chiropractic care, you may be wondering:

- What chiropractic treatments does Medicare cover?

- Will I have out-of-pocket costs?

- How can I reduce my expenses?

Medicare coverage for chiropractic care varies depending on the type of plan you have. Understanding these options can help you maximize your benefits while avoiding unexpected bills.

Medicare Part B: What’s Covered and What’s Not?

Medicare Part B covers chiropractic care, but only for spinal adjustments (spinal manipulation) when deemed medically necessary.

🔹 What may be covered when ordered or delivered by a chiropractor?

✅ Spinal adjustments for treating a misaligned spine (subluxation) diagnosed by a chiropractor

🔹 What’s NOT covered when ordered or delivered by a chiropractor?

🚫 Chiropractic exams and consultations

🚫 X-rays taken by a chiropractor (though an MD-ordered X-ray may be covered)

🚫 Massage therapy, physical therapy, acupuncture, or other treatments

Since Medicare Part B only covers 80% of the allowed amount, patients are responsible for the remaining 20%, unless they have Medigap or secondary insurance (more on that below).

How to Reduce Costs with Part B Medicare:

💡 Tip: Ask your chiropractor for an Advance Beneficiary Notice (ABN) before receiving a chiropractic manipulation deemed not medically necessary by the provider. Medicare never covers these maintenance adjustments. You should be provided this form to help you understand your financial responsibility.

💡 Tip: If your chiropractor recommends additional services (e.g., exams or therapies) that Medicare never covers when ordered or delivered by a chiropractor, be sure to understand your out-of-pocket costs. Ask whether the office is a member of a Discount Medical Plan Network, such as ChiroHealthUSA, where members of that plan enjoy discounted services. Some offices may also offer convenient payment plans.

Medicare Advantage (Part C): Expanded Benefits, But Different Rules

Medicare Advantage (MA), also called Part C, is a private insurance alternative to Medicare Part B. These plans must provide at least the same basic benefits as Original Medicare, but some offer additional coverage.

🔹 Potential Advantages:

✔️ May cover more than just spinal adjustments (e.g., exams, therapies, X-rays)

✔️ Lower out-of-pocket costs compared to Medicare Part B

✔️ Additional perks like dental, vision, and wellness programs

🔹 Possible Disadvantages:

⚠️ Limited provider networks – You may need to see an in-network chiropractor

⚠️ Referral requirements – Some plans require a doctor’s referral for chiropractic care

⚠️ Different billing processes – Copays and deductibles vary

Important: Since each Medicare Advantage plan is different, always check with your insurance company to confirm your chiropractic benefits before scheduling a visit.

How to Reduce Costs with Medicare Advantage:

💡 Tip: Call your insurance company and ask:

- Does my plan cover chiropractic care beyond spinal adjustments?

- Do I need a referral from my primary doctor?

- Are there any restrictions on the number of visits?

💡 Tip: Ask your chiropractor if they accept your specific Medicare Advantage plan to avoid out-of-network costs.

Medigap & Secondary Insurance: Reducing Out-of-Pocket Costs

If you have Original Part B Medicare, you may need extra coverage to help pay for the 20% Medicare doesn’t cover.

🔹 Medigap (Supplemental Insurance):

- Helps cover the 20% of allowed fees that Medicare Part B doesn’t pay

- Some plans cover additional services Medicare excludes, and may cover your Part B annual deductible

- Plans are labeled A–J, with varying coverage levels

🔹 Secondary Insurance (Employer or Retirement Plans):

- Often provided as a benefit of retirement and acts similarly to traditional commercial insurance as a backup to Medicare

- May have different rules and coverage than Medigap

- If you are still working, this insurance may become primary to Medicare.

How to Reduce Costs with Medigap or Secondary Insurance:

💡 Tip: Always provide ALL insurance cards at your chiropractic visit to ensure proper verification and billing.

💡 Tip: If your plan requires pre-approval, ask your chiropractor to help you submit the request.

Key Takeaways: What This Means for You

- Medicare Part B covers only medically necessary spinal adjustments. You’ll pay 20% out-of-pocket unless you have Medigap.

- Medicare Advantage may cover extra chiropractic services, but rules vary by plan.

- Medigap and secondary insurance can help cover costs, but coverage depends on your specific policy.

🔹 Final Tip: Medicare rules can change yearly, so it’s a good idea to review your benefits every year. If you’re unsure about your coverage, contact 1-800-MEDICARE or visit Medicare.gov for updated information.

Still have questions? Your chiropractor’s office can often verify your benefits and help you navigate your coverage.