Don’t Let Timed Coding Rules Misrepresent Your Billing

Many offices provide ancillary therapy services in addition to spinal adjustments. Most of those therapy services have additional rules to follow when it comes to proper billing. They are divided into three specific categories, each with their own rules and guidelines:

Supervised Modalities (CPT 97010-97028)

These are the modality services that do not require direct (one-on-one) patient contact from the provider. Providers, or their designee, can leave the room while the patient receives this service. Common services in this category include unattended electrical muscle stimulation, mechanical traction, diathermy, or hot and cold packs. The distinction here is that these services are not timed-based for billing, and may only be billed once per patient encounter, regardless of the number of applications. For example, applying muscle stimulation pads to the upper back for 10 minutes, then returning to the patient to move the pads to the lower back, for an additional ten minutes of application, is still billed as only one encounter of 97014 or G0283. Documentation includes what was done, where the modality was applied, and for how long.

Constant Attendance Modalities (CPT 97032-97036)

While these services are modalities, they are different from supervised modalities in two ways: they require direct (one-on-one) provider contact with the patient and the codes are time-based for billing. The provider, or their designee, cannot leave the patient while they receive this service. Common services described as constant attendance modalities are ultrasound, attended electrical muscle stimulation, and even laser. At this point, the timed coding rules come into play. In order to seek reimbursement for a unit of service for a constant attendance modality, the provider must spend at least eight minutes (just past the halfway point of 15 minutes) providing that service to the patient. According to CMS (Medicare) guidelines, if the service is performed for less than eight minutes, do not bill for the code. Read on for more details on how to account for time when billing these time-based service codes.

Therapeutic Procedures (CPT 97110 – 97546)

These services are much more closely defined as “physical therapy” procedures. The definition includes “effecting change through the application of clinical skills and/or services that attempt to improve function”. The patient is usually active in the encounter, rather than lying down or sitting to receive a service with these codes (other than muscle work). Common services described as therapeutic procedures are therapeutic exercises and therapeutic activities, neuromuscular re-education, manual therapy, massage and activities of daily living. The provider cannot leave the patient while s/he is participating in or performing the instructions given for this service. Direct (one-on-one) patient contact is required for these codes. As with constant attendance modalities, these are time-based for billing. That means, the service must be performed for at least 8 minutes to be a billable service.

The 8-Minute Rule for Time-Based Coding

The 8-Minute Rule for time coding has been in play for many years. Besides the minimum of 8 minutes of intra-service (active) time required to bill for the service, it further dictates that in order to bill for additional time-based units, you must spend at least another 15 minutes to warrant the next unit of service. After the initial 8 minutes are spent, additional units come in 15-minute increments. The units per number of minutes are calculated as follows:

| Units | Time Window |

| 1 | Greater than or equal to 8 minutes through 22 minutes |

| 2 | Greater than or equal to 23 minutes through 37 minutes |

| 3 | Greater than or equal to 38 minutes through 52 minutes |

| 4 | Greater than or equal to 53 minutes through 67 minutes |

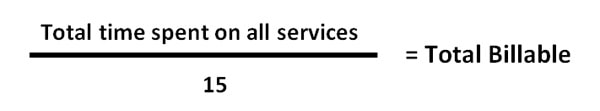

Another easy calculation for billing multiple timed codes performed during the same visit is:

If 8 minutes or more are leftover, bill one additional unit. If 7 minutes or less are leftover, do not bill an additional unit.

The following are several examples of common chiropractic scenarios of therapy time, with the suggested billing protocol:

| Scenario | Proper Billing/Coding |

| Patient receives 6 minutes of therapeutic exercise | Do not bill any CPT code. You have not met the threshold of at least 8 minutes. Document the file and include the service performed and the outcome.

6 minutes = 6 minutes (0 units) |

| Patient receives 21 minutes of therapeutic exercise | Bill CPT code 97110 for one unit. According to the 8-Minute Rule, the chiropractor has not met the requirement (23 minutes) for a second unit.

15 minutes + 6 minutes = 21 minutes (1 unit) |

| Patient receives 28 minutes of therapeutic exercise | Bill CPT code 97110 for two units.

15 minutes + 13 minutes = 28 minutes (2 units) |

| Patient receives 26 minutes of neuromuscular re-education and 25 minutes of therapeutic exercises | Bill CPT code 97112 for two units and bill CPT code 97110 for one unit. You’ve performed a total of 51 minutes. 97112 is assigned two units because it took the most time. Document the exact number of minutes performed for each therapy in the patient health record.

26 minutes + 25 minutes = 51 minutes (3 units) |

| Patient receives 6 minutes of ultrasound, 9 minutes of manual therapy, and 12 minutes of therapeutic exercises | Bill CPT code 97110, therapeutic exercises and CPT code 97140 only. Because the total time is 27 minutes, we may bill 2 units. We bill the two codes where we spent the most time.

6 minutes + 9 minutes + 12 minutes = 27 minutes (2 units) |

When is the last time you had your coding audited? The Office of Inspector General (OIG) of the Department of Health and Human Services (HHS) suggests that an active, viable compliance program includes CPT coding audits. Have yours done by a professional, certified specialist at KMC University. Contact us now!

KMC University is the profession’s expert in third-party payer mechanics. Questions? Contact us today.

Thank you so much for reaching out to me. You made my day! Covid has rocked my practice as I have had to change most things about practicing. Not a bad thing, just new. To know that you and your team still strive to continually improve and stay on top of a tumultuous environment, is truly inspiring. Thank you all for being the heroes we didn't even know we needed